Digital Insights Hub

Your source for the latest trends and insights in digital technology.

Why Your Insurance Quote Might Be Hiding a Surprise

Uncover hidden surprises in your insurance quotes! Learn the secrets that could save you money and avoid unexpected costs.

Understanding Hidden Fees in Insurance Quotes

When comparing insurance quotes, it's essential to understand that the initial price you see may not be the final amount you'll pay. Many policies come with hidden fees that can significantly impact your overall cost. These fees can include administrative costs, brokerage fees, and various surcharges that might not be immediately evident. By failing to account for these additional charges, you could find yourself with an unexpected financial burden when it's time to sign the policy.

To uncover these hidden fees, it is crucial to read the fine print of any insurance quote you receive. One effective strategy is to request a breakdown of the total costs from your insurance provider. Don't hesitate to ask questions about any item you don't understand or that seems unclear. Additionally, comparing multiple quotes side by side can help identify disparities in fees and improve your chances of finding a policy that offers value without excessive hidden costs.

Are You Missing These Key Factors in Your Insurance Quote?

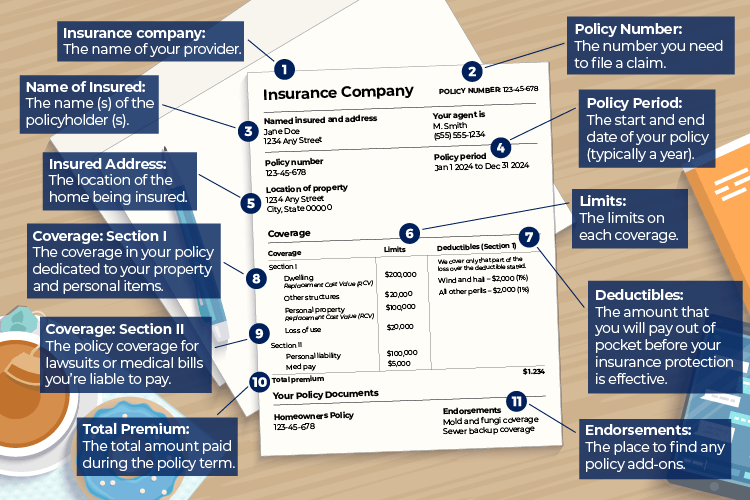

When obtaining an insurance quote, many people focus solely on the premium cost, overlooking key factors that can significantly impact their coverage and overall value. Factors like deductibles, coverage limits, and policy exclusions are crucial to understand. For instance, a low premium may be appealing, but if the associated deductible is high, you could end up paying more out of pocket when it comes time to file a claim.

Additionally, the type of coverage you choose can also affect your insurance quote. It is essential to consider whether you require comprehensive coverage, liability coverage, or a combination of both. Not assessing these key factors can lead to gaps in your coverage, leaving you vulnerable in the event of an incident. Therefore, before finalizing your insurance quote, ensure that you take the time to evaluate these critical components to secure the best possible protection.

Insurance Quote Red Flags: What to Look Out For

When seeking an insurance quote, it's crucial to recognize potential red flags that may indicate a subpar provider. One major warning sign is an unusually low premium that seems too good to be true. If the price is significantly lower than competitors, it may reflect inadequate coverage or hidden exclusions in the policy. Additionally, take note of the company’s customer service. If you encounter difficulty in reaching a representative or receive vague answers to your questions, it could signal underlying issues with their support structure.

Another red flag to watch for is a lack of transparency regarding policy details. Always ensure that the insurance quote outlines all terms, conditions, and exclusions clearly. If the provider hesitates to disclose essential information or uses excessive jargon, tread carefully. Lastly, check the company's reputation through reviews and ratings. A pattern of negative feedback from consumers, especially regarding claims handling, can indicate poor performance in critical areas. By staying vigilant and informed, you can protect yourself from potential pitfalls in the insurance marketplace.