Digital Insights Hub

Your source for the latest trends and insights in digital technology.

Why Whole Life Insurance is the Surprising MVP of Financial Planning

Unlock the hidden power of whole life insurance! Discover why it’s the MVP of financial planning and how it can transform your future.

Understanding Whole Life Insurance: The Hidden Gem of Financial Planning

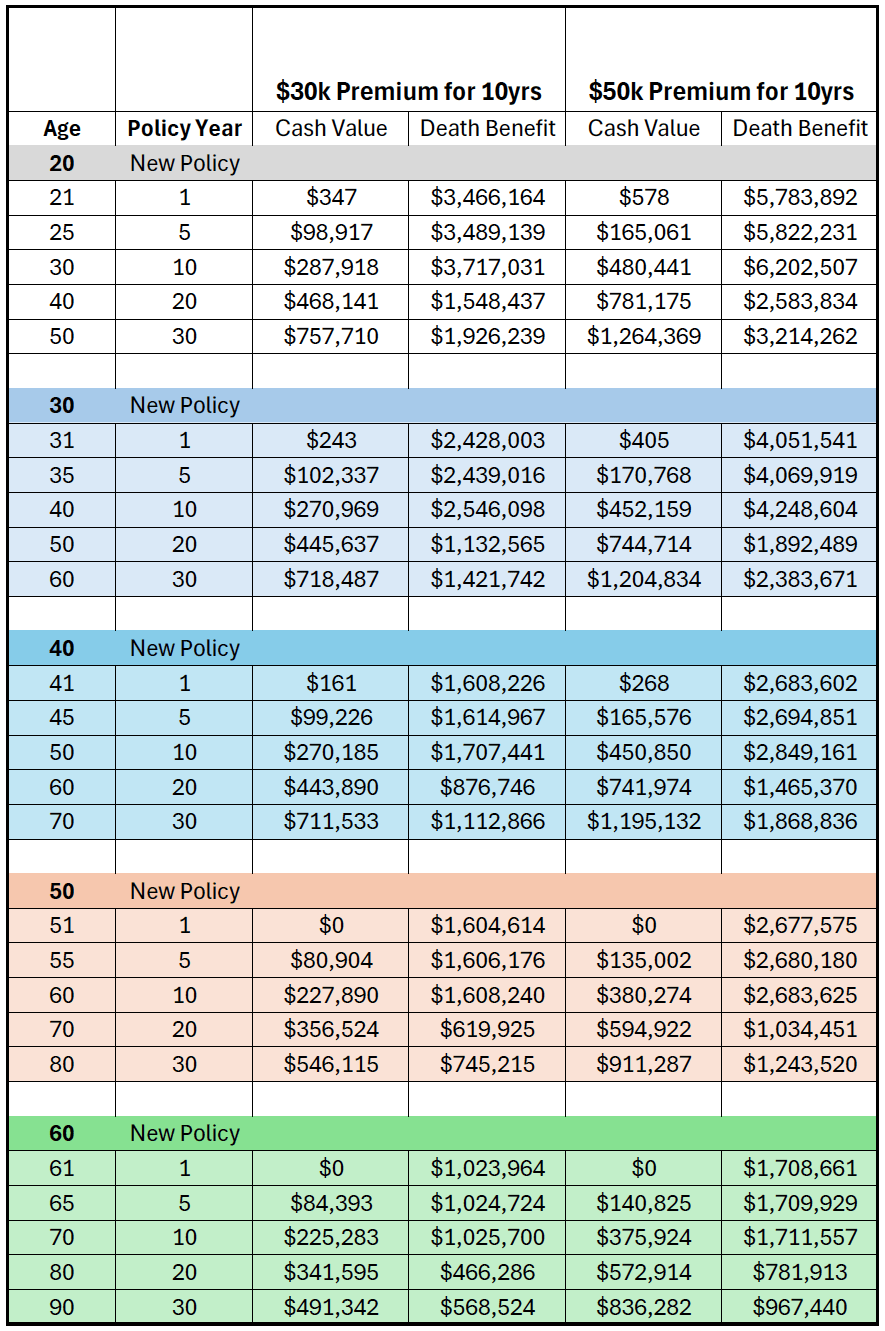

Whole life insurance is often overlooked in the realm of financial planning, yet it serves as a powerful tool for long-term security and wealth accumulation. Unlike term life insurance, which provides coverage for a specified period, whole life insurance guarantees lifelong protection while also building cash value over time. This dual benefit makes it not just an insurance product, but a comprehensive financial strategy that can support various goals—be it funding a child's education, supplementing retirement income, or leaving a legacy for loved ones.

One of the most significant advantages of whole life insurance is its ability to provide a predictable return on investment. The cash value component grows at a guaranteed rate, and policyholders can borrow against it or withdraw funds as needed. Additionally, the death benefit is typically tax-free, offering peace of mind for beneficiaries. With these benefits combined, understanding whole life insurance as a viable financial asset can change the way individuals approach their overall financial planning.

Is Whole Life Insurance the Key to a Bulletproof Financial Future?

Whole life insurance has increasingly garnered attention as a potential cornerstone for a bulletproof financial future. Unlike term life insurance, which expires after a set period, whole life policies provide coverage for the lifetime of the insured and accumulate cash value over time. This accumulation creates an asset that policyholders can borrow against or withdraw from during their lifetime, making it a unique component of a comprehensive financial strategy. Moreover, the guaranteed death benefit offers peace of mind, ensuring that loved ones are financially protected, while the cash value can serve as a safety net in times of financial need.

However, relying solely on whole life insurance may not be the singular solution for achieving a bulletproof financial future. It is crucial to incorporate a diverse range of financial instruments, such as retirement accounts, investment portfolios, and emergency savings, to create a well-rounded approach to wealth management. Balancing whole life insurance with other financial products ensures that you not only benefit from the protection and growth offered by these policies but also have access to liquidity and potential higher returns from investments that align more closely with your financial goals and risk tolerance.

The Long-Term Benefits of Whole Life Insurance: Why It Should Be Part of Your Financial Strategy

Whole life insurance is not just a safety net for your loved ones; it offers a multitude of long-term benefits that make it a crucial component of your financial strategy. Unlike term life insurance, whole life provides coverage for your entire life, ensuring that your beneficiaries receive a death benefit no matter when you pass away. In addition to the death benefit, whole life policies accumulate cash value over time, which can be accessed for various financial needs. This dual advantage of providing both protection and a growing asset is why many financial advisors recommend including whole life insurance in your overall financial plan.

Moreover, the cash value component of whole life insurance acts as a financial cushion. You can borrow against it, allowing for greater flexibility in times of financial need. The cash value grows at a guaranteed rate, offering a conservative yet effective way to bolster your savings. As it is not subject to market volatility, it stands as a safe haven during economic downturns. By incorporating whole life insurance into your financial management strategy, you not only prioritize your family's future security but also build a valuable asset that can enhance your financial stability in the long run.