Digital Insights Hub

Your source for the latest trends and insights in digital technology.

Trade Like a Pro: How Bots are Changing the Game

Discover how trading bots are revolutionizing the market and learn to trade like a pro—maximize profits with cutting-edge tools today!

Understanding Trading Bots: How They Revolutionize Financial Markets

Understanding trading bots is essential for anyone looking to navigate the increasingly complex financial markets. These automated software programs utilize algorithms to execute trades based on predefined criteria, allowing them to analyze vast amounts of data far quicker than human traders. By systematically processing market information, trading bots can identify trends, estimate risks, and react to market changes instantly. This efficiency not only enhances trading accuracy but also saves time, making it easier for traders to implement complex strategies without the constant need for manual intervention.

The way in which trading bots are changing the landscape of finance is profound. They democratize access to sophisticated trading strategies that were once exclusive to institutional investors. Additionally, these bots operate around the clock, which means they can capitalize on opportunities in real-time, regardless of market conditions. With the advent of machine learning and artificial intelligence, trading bots are becoming even smarter, continuously improving their performance based on historical data. As technology advances, it is clear that trading bots will continue to revolutionize how individuals and companies participate in financial markets.

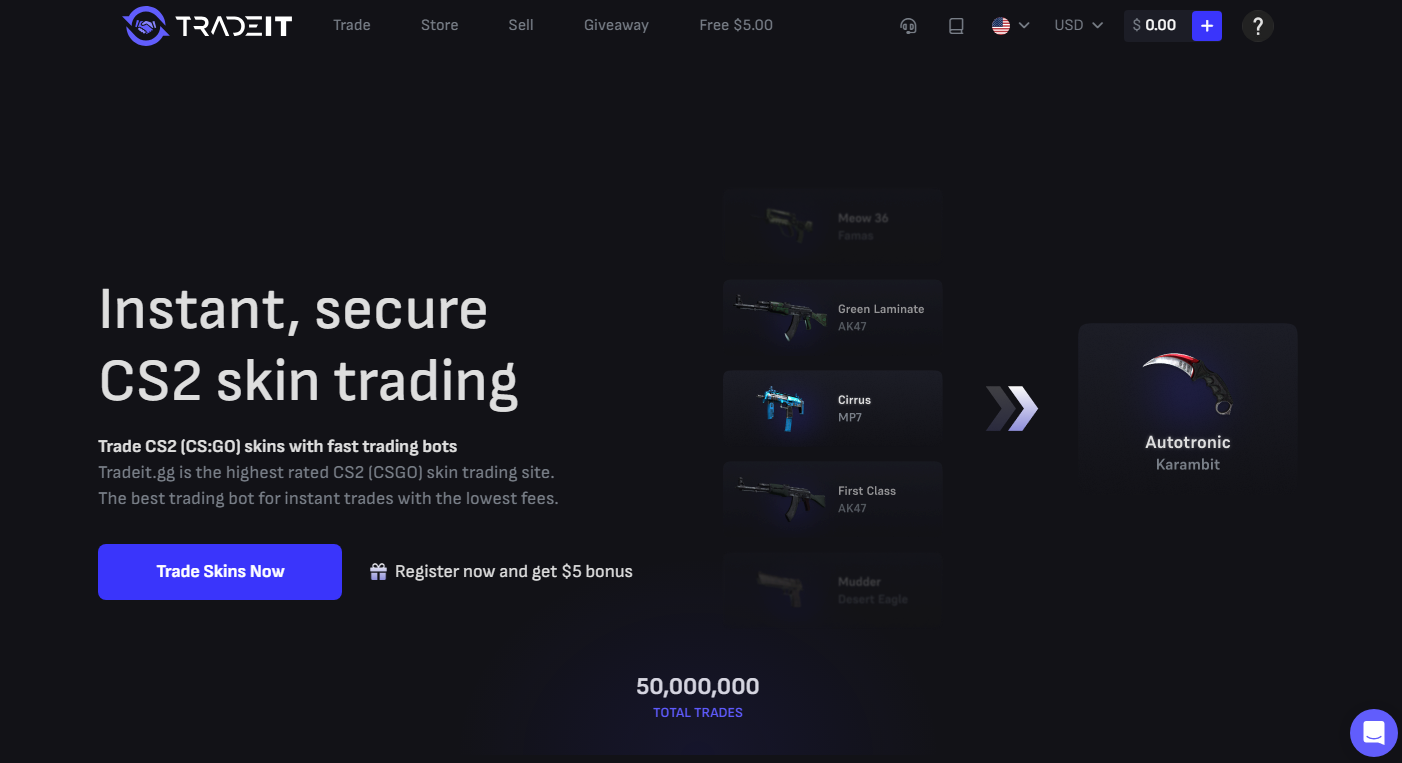

If you're looking to enhance your gaming experience, leveraging technology can make a significant difference. One of the most effective tools available are trade bots, which can streamline the process of managing your in-game items. To learn more about how these innovative tools can transform your inventory management, check out my blog post titled Why CS2 Trade Bots Are the Secret Sauce to Your Inventory!

Top 5 Benefits of Using Trading Bots for Beginners and Pros

Trading bots have revolutionized the way both beginners and experienced traders approach the financial markets. One of the key benefits is their ability to execute trades at any time of the day or night, eliminating the need for constant monitoring of the markets. This is particularly advantageous for beginners who may not have the experience or time to actively manage their trades. Additionally, trading bots utilize complex algorithms that can analyze market trends and price movements much faster than a human trader, allowing for quicker and more informed decision-making.

Another significant advantage of using trading bots is their potential for emotionless trading. Unlike human traders, bots operate based on algorithmic analysis and predefined parameters, which means that fear and greed do not influence their trading decisions. This discipline can lead to more consistent results and help beginners avoid common psychological pitfalls. Furthermore, even seasoned pros can benefit from automating their strategies, freeing up valuable time that can be dedicated to refining trading tactics or exploring new opportunities.

Are Trading Bots the Future of Investing? Here’s What You Need to Know

As the financial landscape continues to evolve, trading bots are gaining significant traction in the investing world. These automated systems use algorithms to analyze market data, execute trades, and optimize strategies, making them a compelling option for both novice and experienced investors. By leveraging machine learning and big data analytics, trading bots can identify patterns and trends more efficiently than human traders, potentially leading to higher returns. However, it is crucial to understand their limitations as well; while they can operate around the clock and make data-driven decisions, they are not infallible and can incur losses in volatile markets.

The future of investing may very well hinge on the integration of trading bots into traditional investment strategies.

- Enhanced efficiency: Bots can process and analyze information at lightning speed.

- Emotionless trading: Unlike human investors, bots don't succumb to emotional decision-making.

- Customizability: Many trading bots can be tailored to fit individual investment goals and risk tolerances.