Digital Insights Hub

Your source for the latest trends and insights in digital technology.

Dueling Insurers: Who's Got Your Back?

Uncover the truth: Which insurer really has your back? Discover tips and insights to choose the best coverage today!

Understanding Coverage: How to Choose Between Dueling Insurers

When navigating the complex world of insurance, coverage options can often feel overwhelming, particularly when you find yourself choosing between dueling insurers. Each provider markets their policies as the best solution, but understanding the nuances of coverage is crucial. Start by comparing the key aspects of each policy, including premiums, deductibles, and coverage limits. Websites like Insure.com offer comparison tools that can help clarify these important factors and guide you toward a more informed decision.

In addition to understanding the basic terms and features, it's vital to consider the customer service reputation of the insurers in question. Look for reviews on sites like Consumer Reports, where you can gauge how each company handles claims and customer inquiries. A policy's coverage might seem attractive on paper, but poor service could result in headaches when it's time to file a claim. Therefore, take the time to research and ask for recommendations to help you select an insurer that not only offers solid coverage but also values its customers.

Dueling Insurers Explained: Which Provider Offers the Best Policy for You?

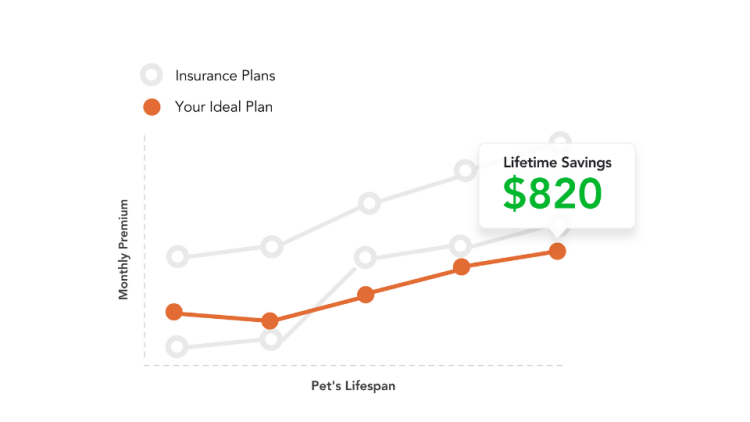

When it comes to choosing an insurance provider, understanding the differences between dueling insurers can be crucial. Many consumers face the challenge of selecting the right policy amidst a sea of options. Factors such as customer satisfaction ratings, coverage options, and pricing all play critical roles in the final decision. In this environment, being well-informed can lead to substantial savings and better coverage. Researching insurers thoroughly and comparing their offerings can help you identify the best fit for your unique needs.

To effectively navigate through the offerings of competing insurers, consider evaluating the following criteria:

- Coverage Options: Look for policies that best match your requirements, whether it’s health, auto, or home insurance.

- Pricing: Compare premiums and deductibles among different providers to ensure you get competitive rates.

- Customer Service: Read customer reviews and ratings to see how insurers handle claims and support their policyholders.

Five Key Questions to Ask When Comparing Competing Insurance Policies

When evaluating various insurance policies, it's essential to ask the right questions to ensure you're making an informed choice. Here are five key questions to consider:

- What is covered under the policy?

- What are the exclusions?

- What is the deductible amount?

- How are claims processed?

- What is the policy's renewal process?

Understanding the specifics of coverage will help you compare policies effectively. For more detailed insights, you can refer to Insurance.com.

Once you've clarified coverage and exclusions, pay close attention to the deductibles and claims processing. A lower deductible may seem appealing, but it can result in higher premiums. Similarly, understanding the claims process can prevent headaches later on. To dive deeper into how these factors influence your decision, check out NerdWallet.