Digital Insights Hub

Your source for the latest trends and insights in digital technology.

Digital Market Arbitrage: Outsmarting the Competition One Click at a Time

Unlock hidden profits with Digital Market Arbitrage! Outsmart competitors and maximize your clicks—start your journey to success now!

Understanding Digital Market Arbitrage: A Comprehensive Guide

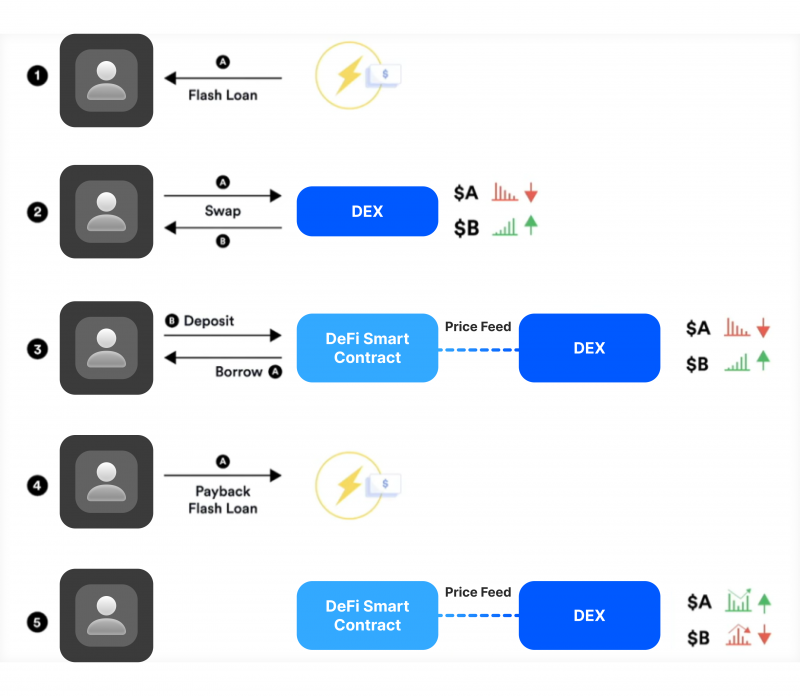

Understanding Digital Market Arbitrage involves grasping the concept of buying and selling digital assets or products across different platforms to generate profit. This strategy is grounded in the idea that price discrepancies exist between various markets. For instance, a product may be available at a lower price on one platform and subsequently resold at a higher price on another. To succeed in digital market arbitrage, one must engage in rigorous market research, ensuring they identify these price differentials accurately. A successful arbitrageur must also be adept at evaluating factors such as transaction costs and market demand to determine the potential profitability of a trade.

In addition to understanding market dynamics, an effective arbitrage strategy will often employ automated tools and software that streamline the buying and selling process. Techniques such as algorithmic trading can enhance the speed and efficiency of transactions, allowing arbitrageurs to capitalize on fleeting opportunities. Whether you’re interested in e-commerce, cryptocurrency, or financial trading, understanding the nuances of digital market arbitrage can open new avenues for revenue generation. Remember, consistent monitoring of your chosen markets and adjusting your strategies in response to market fluctuations are vital for long-term success.

Counter-Strike is a popular tactical first-person shooter game that emphasizes teamwork and strategy. Players can engage in various game modes, including bomb defusal and hostage rescue. For those looking to enhance their gaming experience, using a csgoroll promo code can provide exciting benefits.

Top Strategies to Outsmart Competitors in Digital Market Arbitrage

In the highly competitive landscape of digital market arbitrage, leveraging advanced strategies is essential for staying ahead of your competitors. First, conducting comprehensive market research will help you identify trending products and profitable niches. Utilize tools like Google Trends and SEMrush to analyze search patterns and keyword performance. By targeting high-demand areas that your competitors may overlook, you can optimize your campaigns for maximum profitability. Establishing a robust network of reliable suppliers and affiliates is also critical, enabling you to respond swiftly to market fluctuations and improve your margins.

Another effective strategy to outsmart competitors is to enhance your data analytics capabilities. By leveraging analytics tools such as Google Analytics and Facebook Insights, you can gather actionable insights on customer behavior and campaign performance. These insights can guide your decision-making processes and allow you to fine-tune your marketing strategies. Additionally, consider implementing A/B testing for your advertisements and landing pages, as this can significantly improve conversion rates. Ultimately, by continually refining your approach based on data-driven insights, you can maintain a competitive edge in the ever-evolving world of digital market arbitrage.

What Are the Key Risks and Rewards of Digital Market Arbitrage?

Digital market arbitrage presents a compelling opportunity for investors and traders seeking to capitalize on price discrepancies across different platforms. However, it's essential to acknowledge the inherent risks associated with this strategy. One of the primary risks is market volatility, which can lead to rapid changes in asset prices, potentially eroding profits before trades can be executed. Furthermore, liquidity risk poses a challenge, as some markets may not offer enough volume to allow for prompt transactions without significant price impact. Additionally, regulatory risks can arise, especially as governments worldwide continue to develop and enforce digital asset regulations that may disrupt established trading practices.

Despite these risks, the rewards of digital market arbitrage can be substantial. Traders can benefit from the ability to exploit price differentials across various exchanges, leading to profits that might not be available in a more stable market. Moreover, with the right tools and algorithms, traders can automate their strategies, reducing the time and effort required to monitor multiple platforms for opportunities. By maintaining a keen understanding of market dynamics and implementing robust risk management strategies, participants can navigate the challenges of arbitrage effectively and maximize their potential gains.