Digital Insights Hub

Your source for the latest trends and insights in digital technology.

When Trades Turn: The Curious Case of CS2 Reversals

Discover the surprising twists in CS2 trading as we explore the phenomenon of reversals and what it means for your strategy!

Understanding Reversals: The Mechanics Behind CS2 Trade Flips

In the world of trading within Counter-Strike 2 (CS2), understanding the mechanics behind trade flips is crucial for maximizing profit and minimizing risk. A trade flip, in essence, occurs when a player exchanges a skin for another, often leveraging market fluctuations and player demand. By analyzing trends, players can identify potential reversals in skin value, allowing them to capitalize on short-term price movements. Advanced traders utilize various tools such as historical data analysis and market sentiment to inform their decisions. This strategic approach ensures that they remain several steps ahead in the fast-paced trading environment of CS2.

To successfully navigate trade flips, it’s essential to grasp the concept of market sentiment and its influence on reversals. Players should be keen observers of community trends, including the popularity of certain skins, seasonal events, and promotional sales that can impact value. For instance, during major updates or tournaments, certain items may experience a surge in demand, creating opportunities for profitable trade flips. Establishing a solid understanding of these mechanics not only enhances trading instincts but also fosters a more rewarding experience within the CS2 ecosystem.

Counter-Strike is a popular first-person shooter that has captivated gamers worldwide since its initial release. In this competitive game, players can engage in thrilling matches, and a unique aspect of it is trading in-game skins. If you're interested in learning how to reverse trade cs2, numerous resources are available to help you understand the mechanics and strategies involved.

When to Spot a Trade Turn: Key Indicators in CS2

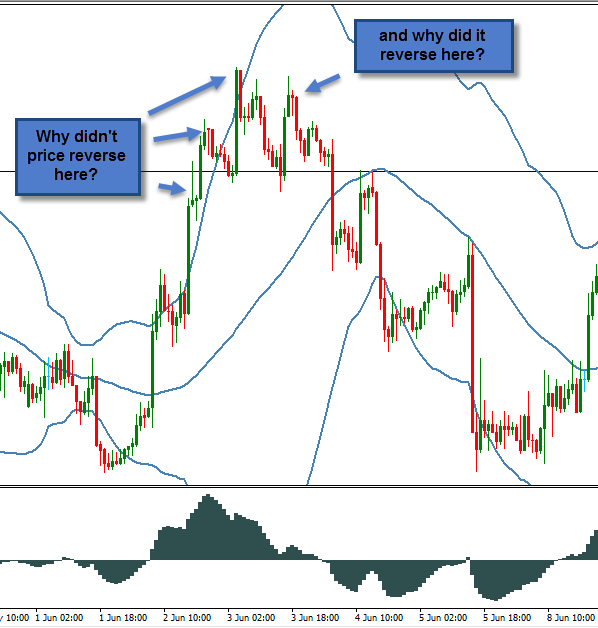

In the world of CS2, knowing when to spot a trade turn is crucial for maximizing your competitive edge. One of the most significant indicators is the change in momentum, which can often be identified through pivotal price patterns such as head and shoulders or double tops/bottoms. These formations represent a shift in market sentiment, signifying that the previous trend may be losing strength. Furthermore, traders should pay attention to volume trends; an increase in volume during a reversal pattern can validate the move, reinforcing the potential for a trade turn.

Another key indicator to watch for is divergences, particularly between price action and momentum indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). A divergence occurs when the price moves in one direction while the momentum indicator moves in the opposite direction, suggesting a possible reversal is on the horizon. Additionally, keeping an eye on support and resistance levels can provide vital clues. When the price approaches a strong support or resistance level with weak momentum, traders may anticipate a trade turn, allowing them to position themselves effectively ahead of the shift.

Is CS2 Reversal Trading a Viable Strategy?

In the realm of CS2 reversal trading, traders often seek to identify crucial price levels where reversals are likely to occur. This strategy hinges on understanding market psychology and the dynamics of supply and demand. When a stock or asset reverses direction after a significant trend, it can present lucrative opportunities for profit. However, the efficacy of this approach varies depending on market conditions, trader skill, and the specific indicators used to make trading decisions.

To assess whether CS2 reversal trading is a viable strategy, one needs to consider both the risks and rewards. Key elements such as proper risk management, timing, and the use of technical indicators play a significant role. Many traders prefer to combine reversal trading with other strategies, creating a more comprehensive trading plan that aims to minimize losses while maximizing potential gains. Ultimately, while reversal trading has its merits, it requires diligent research and practice to navigate effectively.